PIX dominates the iGaming payments segment, with 81% of surveyed buyers relying on it for its superior security.

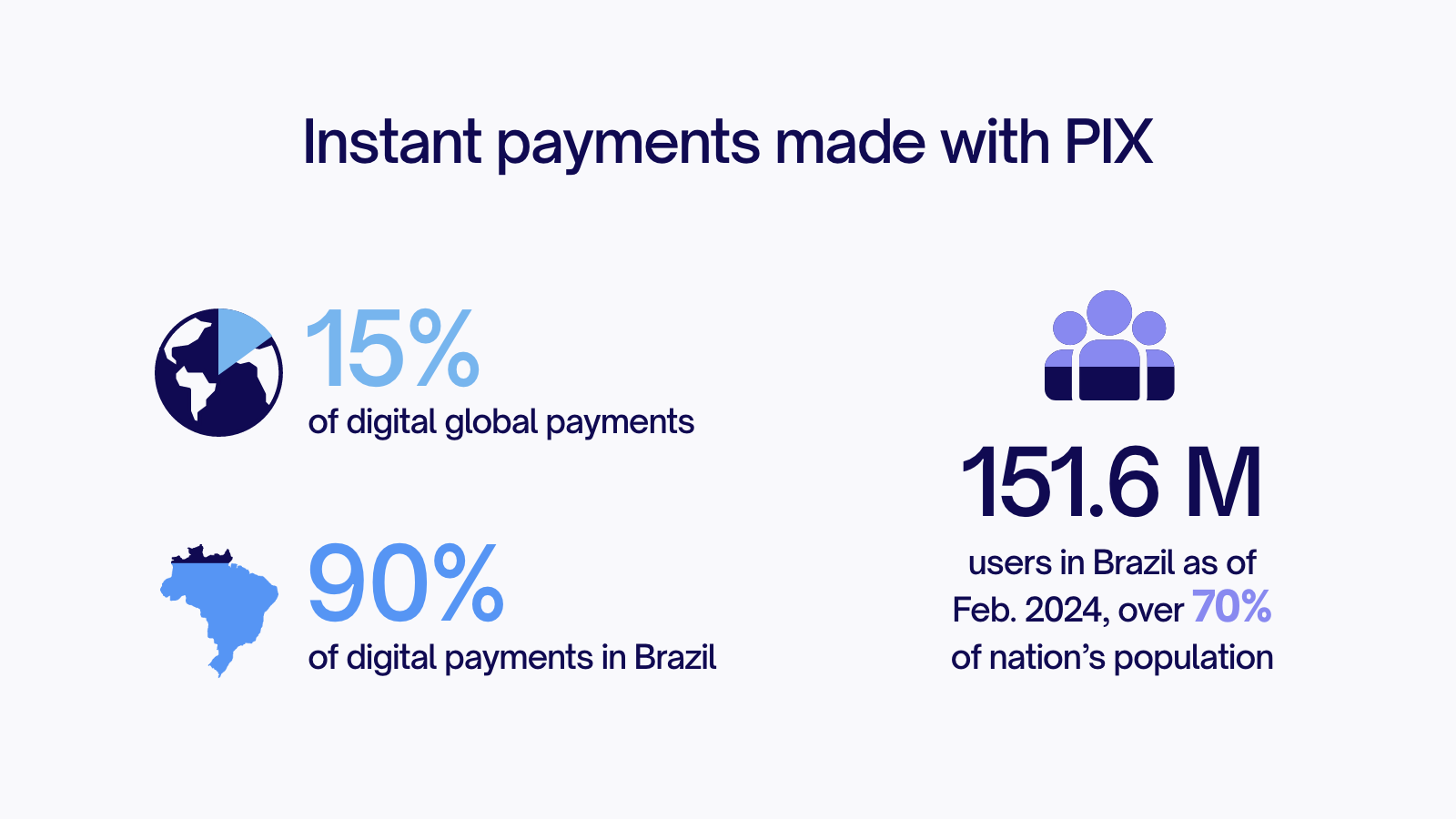

PIX became the primary mode of digital transactions in Brazil within 2 years of its launch in 2020. The payment solution has put Brazil on the world map of digital payments. Brazil’s PIX accounted for 15% of the global instant payments[1], second only to India’s Unified Payments Interface (UPI), in 2023. The platform’s seamless operability across banks and the elimination of intermediaries are driving its growth. The popular payment option serves as a guideline for digital payment enablement across and beyond Brazil. It has become imperative for every digital player to integrate PIX into their online platforms to establish a broad footprint in the country.

Source: https://www.em.vc/insights/2024/1/31/the-emerging-markets-leadership-on-real-time-payments-a-comparison-of-indias-upi-and-brazils-pix-1

Here’s what you need to know.

What is PIX?

The Brazilian government introduced PIX as an alternative to cash during the pandemic to ease the lives of citizens. It is a more affordable, accessible, and faster mode of transacting, compared to legacy payment methods, such as bank slips, PayPal, Skrill, cryptos, and debit/credit cards.

PIX is extremely easy to use. It allows users to send money by entering the recipient’s phone or CFP (Brazilian Tax ID) number. In addition, instant confirmation assures users of payment settlement, even if the recipient is not a registered PIX user.

The platform is operational 24/7 and does not charge fees for most types of transactions. Complete visibility of the recipient’s details throughout the transaction process, without the need for an additional digital wallet, has made it popular among Brazilians. It has also enabled greater financial inclusion in the country.

Top Benefits of PIX

PIX offers immense benefits for merchants and end users.

Instant Settlement

Credit and debit are completed in real-time with PIX. This enables eCommerce companies and merchants to offer better customer experiences and build lasting relationships.

Digital commerce businesses can make instant payments to their partners, vendors, contractors, and gig workers, to elevate business positioning. Better-than-the-rest business conditions giving them an opportunity to negotiate terms of association with greater confidence.

Enhanced Liquidity Management

Instant availability of funds empowers businesses to gain a clear picture of their capital flows. They can pay off their debt faster and choose to reinvest strategically as funds are always available to them.

Greater Security

Developed by the Brazilian Central Bank (BCB), with robust technology and a cutting-edge security framework, PIX offers a safe transaction mechanism for merchants and users.

High Interoperability

Along with seamless operations with Brazilian standard banks, PIX can be used with diverse e-wallets via QR codes. This further enhances its interoperability across digital payment systems in the country.

PIX as the Main Payment Method in Brazil

Did you know that PIX dominates the iGaming payments segment, with 81% of surveyed buyers[2] relying on it for its superior security?

According to the International Monetary Fund[3], “PIX has greatly exceeded usage expectations and fostered financial inclusion”. As of February 2024, the platform had acquired over 151.6 million users[4], which is over 70% of the nation’s population, according to the BCB (Brazilian Central Bank).

Now, 90% of digital payments in Brazil are completed using PIX. The payment method is also gaining popularity in neighboring countries and is projected to gain a market size of $121 billion by 2025 across Latin America.

Current Payment Methods for Online Casinos in Brazil

PIX has gained popularity and established a deep footprint despite the long-standing alternatives, including bank cards, Boleto, e-wallets, and cryptocurrencies. This is because the traditional payment mechanisms suffer from various bottlenecks, such as:

- Limited banking hours and the involvement of intermediaries introduce unwanted delays in transaction settlement.

- User interfaces are slow, dated, and tedious.

- There is significant involvement of third parties, which Brazilians are skeptical of and, hence, do not trust much.

CommerceGate’s PIX Solution Offers Unique Features for Online Casinos

A key strategy to expand across geographies is to offer hyper-localized payment options to reduce hesitation and build trust among users. The best way to tap into the potential of new markets is to leverage the targeted expertise of a technology provider with local expertise and a team and offices in Brazil. Since PIX is free, considered as safe as wire transfers, and is always available, it is the preferred mode for online transactions among Brazilian consumers.

CommerceGate’s PIX payment user interface is highly configurable and designed for user convenience, ensuring friction-free use on desktop and mobile devices. Biometric identity verification and customizability enable you to hyper-localize your payments portal. It is optimized to meet the requirements of Brazilian gamers, who largely use mobile phones for gaming and transactions.

There are several other benefits of partnering with us:

- Although the BCB advises a 12-second transaction time, our solution confirms payments in less than 4 seconds, giving your customers superior experiences.

- High-speed, secure transactions significantly lower checkout friction, reducing cart abandonment at the last step of the consumer’s acquisition ladder.

- With 95% penetration, our PIX payment solution positions you for a larger user base in the Brazilian online player community.

- The merchant onboarding and operation fees are much lower than that of traditional payment modes.

- Our PIX payment solution’s architecture significantly reduces typical card fraud and chargeback volumes.

- We maintain a competitive AR of over 85% for PIX transactions.

- There are no hidden FX charges for transfers between pay-ins and pay-outs for R$-denominated payment accounts.

- CommerceGate offers a Static PIX solution for an increase of Customer Lifetime Values of 6-7%.

Conclusion

PIX delivers a universal, cost-effective, and user-friendly mechanism for payment fulfillment. Global central banks, including the US Federal Reserve and the European Central Bank, have taken notes from the Brazilian payments solution to enable real-time transactions in their respective regions.

CommerceGate is one of the leading providers of PIX payment enablement for iGaming, sports betting, and online casinos in the world’s 5th largest online gaming market. Our tried and tested solution, equipped with exceptional features and competitive pricing, allows you to ensure countrywide accessibility. Plus, our superior security framework supports you to position yourself as a safe platform in the country known for its affinity to sports.