With a huge fanbase, the online betting industry in the sports-loving nation is rapidly evolving and poised to present a multitude of business opportunities. iGaming operators need to adopt proven strategies to optimize revenues in the nation that is poised to become the largest sports betting market in the world.

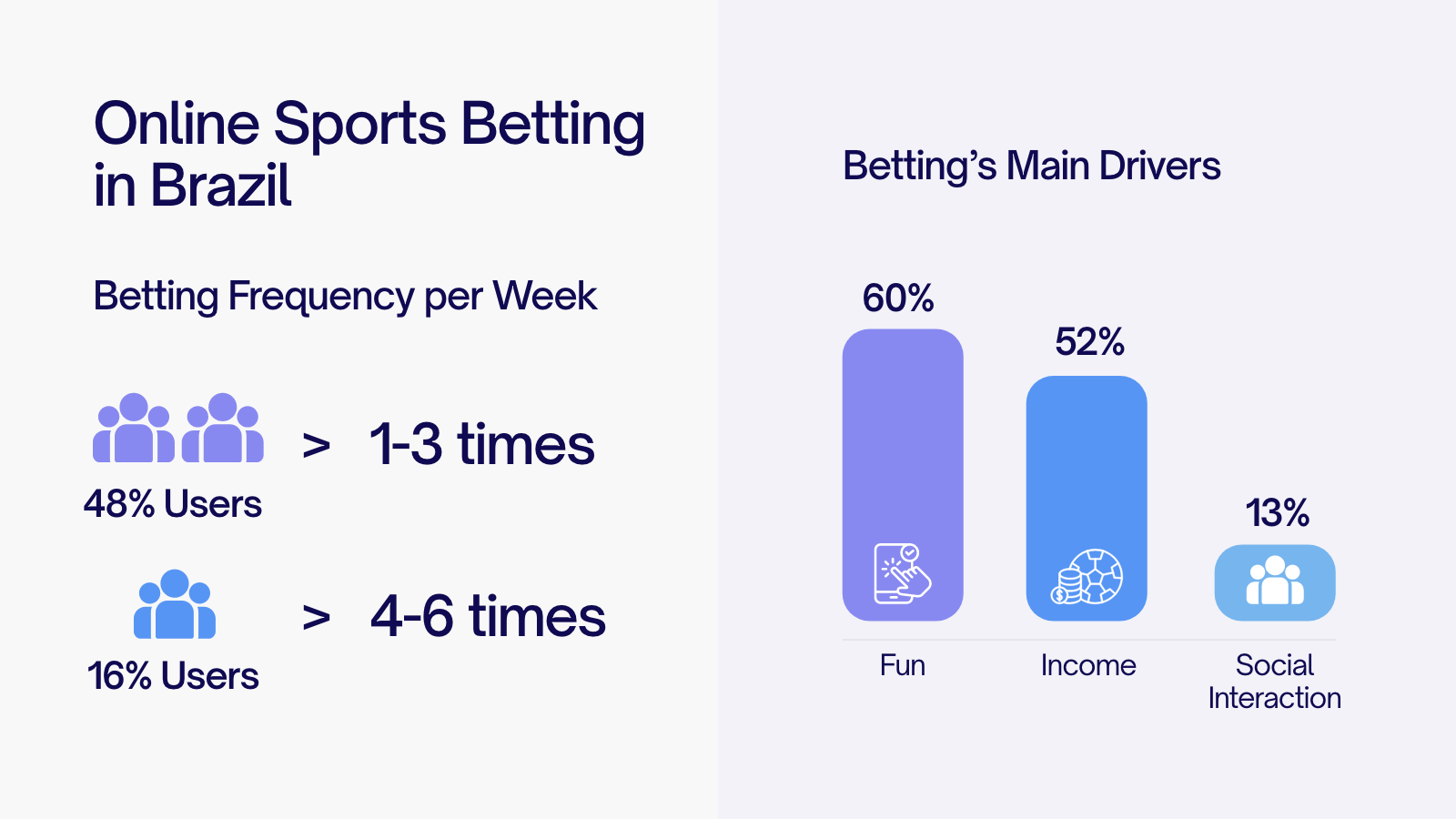

Online sports betting is embedded deep in the culture of Brazil. While 60% of bettors do it for entertainment, 52% consider it a source of income, and 13% use it as a way of socializing with friends[1]. Avid participants place bets at least 4 times a week, and 16% of customers fall in this category while 48% are moderate users with a betting frequency of one to three times a week.

With such a huge fanbase, the online betting industry in the sports-loving nation is rapidly evolving and poised to present a multitude of business opportunities. iGaming operators need to adopt proven strategies to optimize revenues in the nation that is poised to become the largest sports betting market in the world.

Source: https://sambadigital.com/globos-exclusive-survey-provides-an-in-depth-look-into-brazilian-gamblers

6 Best Practices for Success in Brazil’s Online Betting Market

The sports betting landscape of Brazil is filled with participants. Differentiating in such a competitive environment requires a tactical approach.

1. Prioritize Customer Care

In a competitive industry, superior customer experience is the number one differentiator. Brazilian customers are used to getting support directly on WhatsApp. Self-service-based customer service models are popular and appreciated.

2. Address ReclameAQUI Feedback Promptly

ReclameAQUI, with 18 million users, is the most popular customer grievance platform in South America. Monitoring the platform regularly allows brands to discover the issues users face and resolve them quickly. Stay active on the platform to offer prompt responses and establish yourself as a client-first business.

3. Don’t Underestimate PROCON-SP and IDEC

While the regulatory framework in the country is still evolving, the consumer protection infrastructure is well-built and active. PROCON, an organization consisting of over 800 consumer protection agencies across states, and the Brazilian Institute of Consumer Defense (IDEC) are two powerful agencies laying the ground rules for every business to uphold the interests of consumers in the country. Make sure your operations align with the guidelines applicable to the specific jurisdiction you operate in.

4. Stay Updated on Regulatory Changes

Brazil is still shaping regulatory standards for its online gaming industry. In this evolutionary landscape, keeping an eye on updates from relevant authorities is critical to ensuring compliance and penalty-free operations in Brazil. However, for every online business, especially those that need to facilitate payments, maintaining KYC/AML standards, ensuring claim management, and protecting user privacy are paramount.

5. Blend in With the Local Market

The best way to expand your market share in the Brazilian iGaming industry is to offer localized experiences. For instance, sending out reminders to consumers to “gamble responsibly.” Also, tailor your offerings, such as gaming language, arena graphics, etc., to the local preferences.

6. Simplify Transactions

A secure and reliable transaction mechanism is crucial to ensuring continued revenues. PIX’s ease of use, seamless integration across platforms, and affordability have made it the go-to payment method in Brazil and some of the other LATAM nations. With that level of popularity, implementing PIX is not a choice but a necessity.

CommerceGate’s PIX Platform is equipped with compliant AML, anti-fraud, and KYC measures. Our proprietary and unique PIX solution offers benefits, improving our merchants’ operational and commercial effectiveness, efficiency and client lifetime value (CLTV) increases of up to +7%.

- Instant access to funds in BRL (Brazilian Real), with no FX charges applied.

- Proprietary PIX flows covering Dynamic and Static QR codes.

- Average transaction time of only 3.7 seconds.

- Advanced PIX fraud prevention with a unique QR-code created for each individual user tax-ID.

- Fully transparent pricing tiers with no hidden fees.

- Transparent FX and overseas settlements.