Pix is the best way to pay for things in Brazil, both online and in presence. The instant payment method offers a seamless experience for customers making an online transaction: in fact, Pix’s payment conversion rates can come up to 90% in e-commerce.

With a population of 215M and an internet penetration rate of 80% — representing Latin America’s largest digital population[1] — companies looking to expand their operations can find fertile ground in Brazil. And payment methods play an essential role in their success — especially Alternative Payment Methods (APMs), which operate locally.

In this article, we’ll overview the payment landscape in Latin America’s largest market and cover the most popular payment methods in Brazil. Let’s dig in!

Brazil’s Payment Landscape Is Digital-First

Four years ago, “Do you take cards?” was a commonly asked question by Brazilians when purchasing in physical stores — and many would often hear back “No, just cash”. The reason? Because cash was such a popular payment option in Brazil, many merchants didn’t see an advantage in paying the fees applied by acquirers.

But this all changed in November 2020 with the launch of Pix, the Central Bank of Brazil’s instant payment method.

In just 4 years, Brazilians went from heavily relying on cash to a digital-first population. In August 2023, a whopping 82% of smartphone users revealed they had already made a QR code payment, according to a study carried out by Mobile Time and Opinion Box.[2]

The same data shows that in March 2020 — just months before Pix’s introduction to the Brazilian population — the number stood at only 35%.

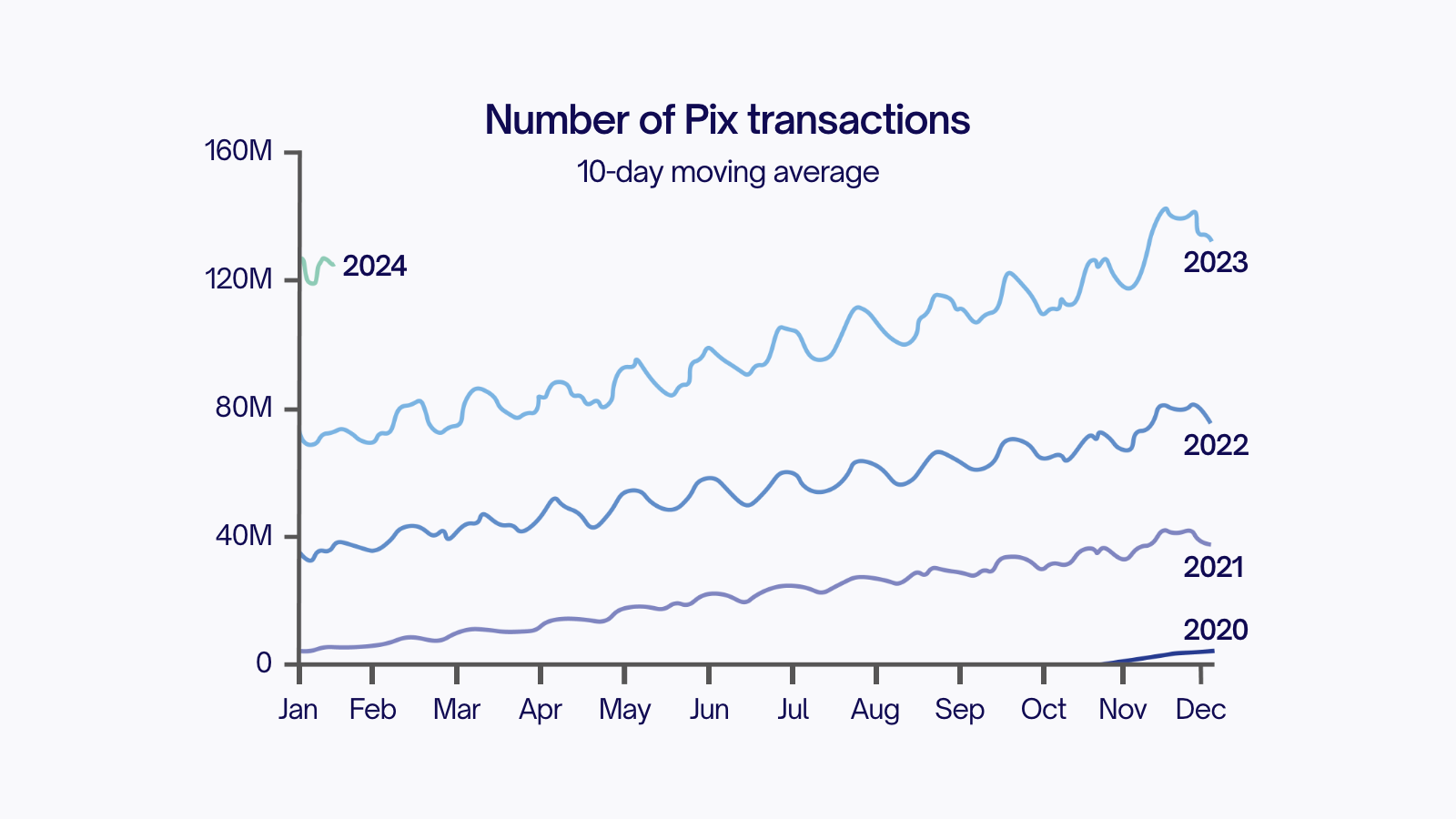

Source: https://info.ceicdata.com/brazils-instant-payments-pix-keep-disrupting-the-transactions-system-three-year-post-launch

What Is Pix?

Pix is Brazil’s local payment method, launched by the Central Bank of Brazil[3] in November 2020. It allows instant digital transactions with amounts as low as R$0,01, twenty-four hours a day, seven days a week. With Pix, a user from Bank A can pay whatever amount they need to a user from Bank B at any time of the day, and the amount is instantly made available regardless of the payment institution.

The instant payment method has introduced 71.5M+ users in the financial system, according to data from the Central Bank of Brazil[4]. “In a short period, Pix revolutionized the way Brazilians make payments and carry out financial transactions”, says the Central Bank in the official note.

Further, according to a study carried out by Febraban, Pix established itself as the most popular payment method in 2023, with nearly 42 billion transactions — a 75% increase compared to the previous year. The estimates for 2024 are even higher.

The convenient, easy-to-use, cost-effective, and real-time payment method may well be one of the main drivers for the surge of digital banks and digital wallet uses in Brazil. That same study from Mobile Time and Opinion Box showed that only 5% of Brazilians don’t have an account with a digital bank or digital wallet, e.g. Nubank, PicPay, Mercado Pago, and PayPal. Free from charges and embedded with Pix, these payment solutions serve as checking accounts for millions of Brazilians, allowing them to send and receive money instantly at zero costs.

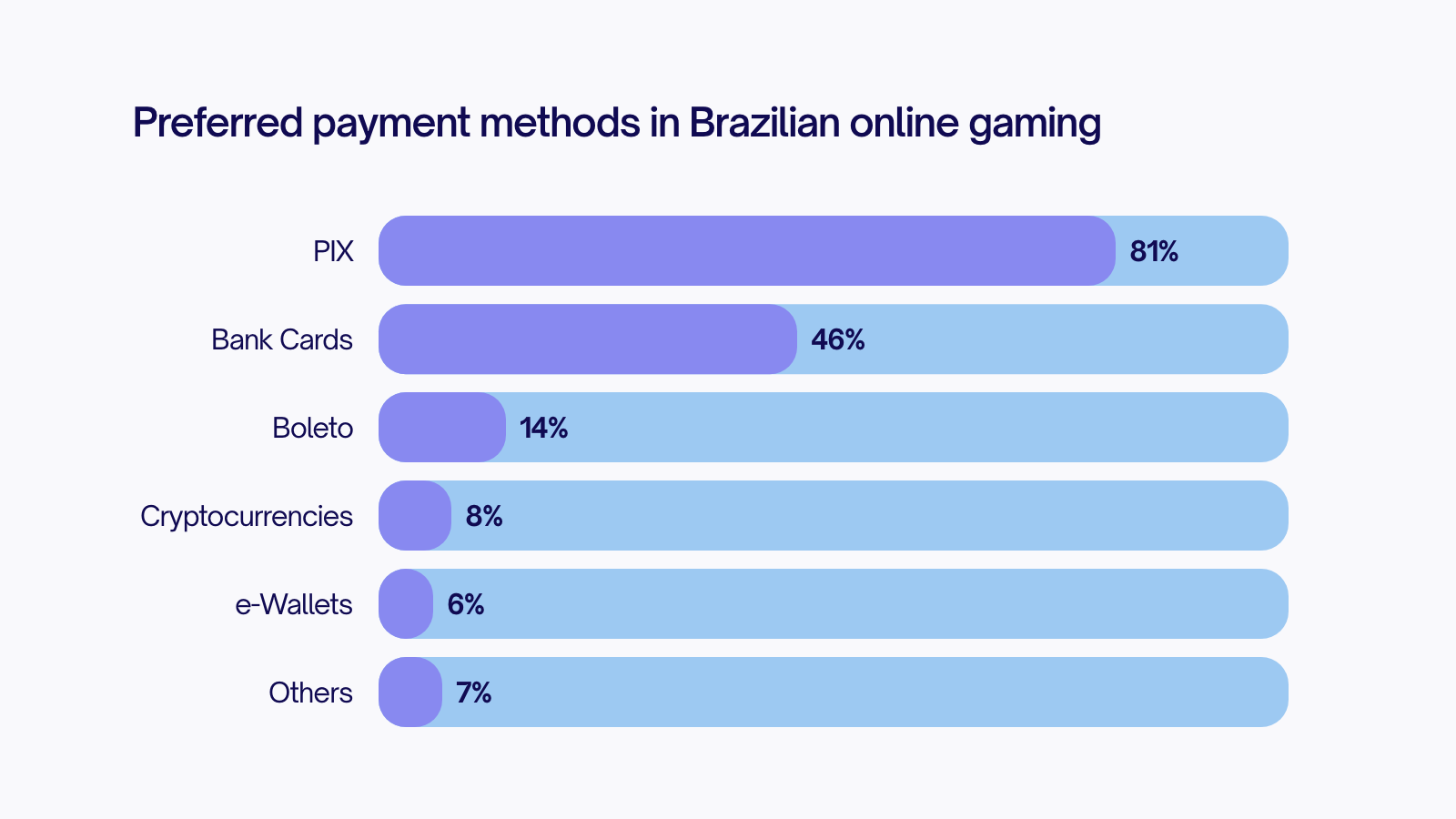

Source: https://env.media/popular-payment-methods-brazil-igaming

How Brazilians Pay: An Overview of E-commerce Payments In Brazil

Even with its massive popularity, when it comes to purchasing physical goods online, credit cards take the first place as Brazilians’ preferred payment method due to the installment payment option.

However, it’s important to note that the stats can vary from industry to industry. In the iGaming sector, for instance, Pix dominates the payment landscape by far, with a whopping 81% preference[5]. Bottom line? Industry — and, for that matter, average ticket — play a crucial role in Brazilian consumer payment preferences.

What Payment Methods Are Used In Brazil?

In addition to Pix, Brazilians can pay for their online purchases using a variety of payment methods, like:

Credit and Debit Cards

With Brazil’s growing e-commerce market and evolving digital finance landscape, the use of credit and debit cards in Brazil has become widespread. In fact, by 2022, the number of active cards had surpassed the country’s population.

One of the main reasons credit cards are so popular in Brazil is credit card installment payments, a payment modality offered by acquirers that allows Brazilians to pay for their purchases in monthly installments using their credit cards. The number of available installments can vary from store to store, but most merchants offer customers the possibility to pay for their purchases in up to 12 monthly installments.

Boleto Bancário

With Boleto, users issue a payment slip that can be paid online or in cash through a lottery agency. However, the payment compensation can take up to 2 business days. While this does not affect the online payment process, the purchases aren’t immediately sent or made available to consumers as they have to wait for the payment compensation.

Digital Wallets

Digital wallets like PayPal, PicPay, and Ame, are also widely used in Brazil. However, most users use digital wallets as checking accounts to carry out transactions using cards or APMs like Pix and Boleto Bancário.

Our Verdict: What Is The Best Way To Pay For Things In Brazil?

Pix is the best way to pay for things in Brazil, both online and in presence.

The instant payment method offers a seamless experience for customers making an online transaction: in fact, Pix’s payment conversion rates can come up to 90% in e-commerce.

Businesses can leverage Pix for their online businesses in Brazil by partnering with a trusted payment solution like CommerceGate.

Meet CommerceGate’s Unique Pix Solution

CommerceGate allows businesses to plug into Latin America and leverage the power of real-time transitions in Brazil with a native, user-friendly Pix payment solution, ensuring top security, scalability, and transparency. CommerceGate’s proprietary Pix flows cover Dynamic and Static QR Codes and AML checks that help you drive consumer loyalty and spending.

CommerceGate’s highly customizable Pix Payment Platform eases your entry into Brazil. With a fully authorized service provider at your side, you can be sure of:

- Customized business solutions.

- Proprietary PIX flows covering Dynamic and Static QR codes.

- Advanced Pix fraud prevention with a unique QR code created for each individual user’s tax ID.

- Top-tier security.

- Efficient trade execution.

- High authorization rates.

- Expedited fund settlement.

- Superior customer service.