Payment processors like CommerceGate can help you boost your sales in Brazil with proprietary payment solutions, streamlining, and simplifying the consumer experience while also increasing authorization rates.

Selling To Brazil 101: The Importance Of CPF For Online Transactions

Looking to sell online to Brazil?

Then the first thing you should keep in mind is the acronym: CPF.

CPF stands for Cadastro de Pessoa Fisica, which can be loosely translated to “Individual Registration”. In other words, the CPF is the Brazilian individual taxpayer identification number.

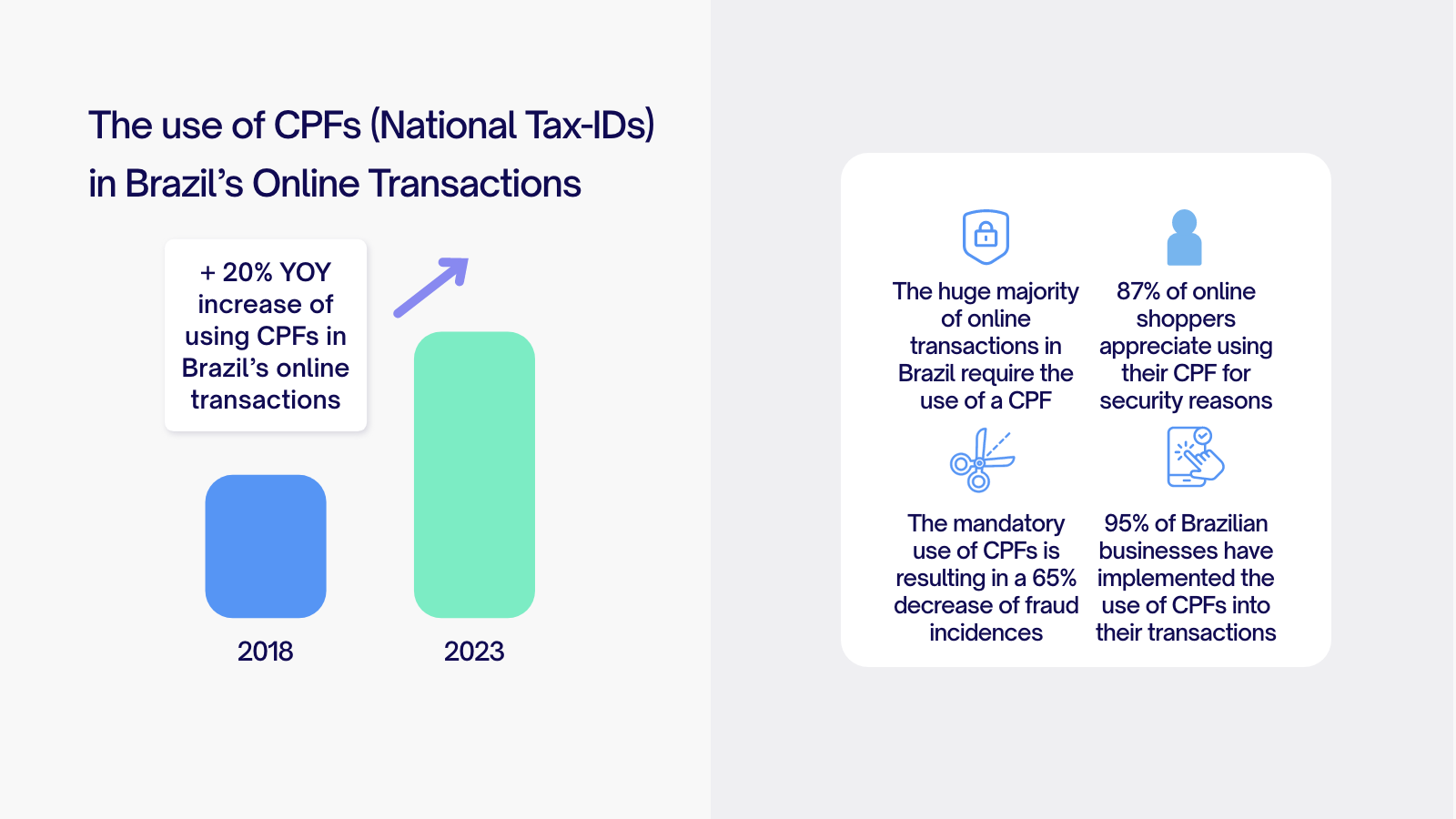

While according to the Codigo de Defesa do Consumidor (CDC) – that is, the consumer protection code – customers aren’t required to inform their CPFs for in-presence purchases, this goes the other way for online purchases.

When shopping online in Brazil, consumers must inform their CPFs to local entities, so the Nota Fiscal Eletronica (NF-e) – fiscal receipt – is issued to the Receita Federal, the Brazilian tax authority.

This also goes to foreign companies shipping products to Brazil: as of January 1st, 2020, all international parcels arriving in Brazil must include either the customer’s CPF or passport number to meet regulations from the Receita Federal.

Source: https://www.gov.br/receitafederal/pt-br

No Shipping? You Still Need To Meet Requirements

But let’s say your company sells digital goods and doesn’t ship physical products to Brazil. Does your company still need to meet requirements?

The short answer is: it depends.

If a Brazilian consumer holding an international credit card wants to purchase digital goods from your online store, they can do so without informing their CPF.

But with currency exchanges and the Imposto Sobre Operacoes Financeiras (IOF), this transaction will cost them more money – meaning they won’t hesitate to seek your competitor offering local payment options, such as credit card with installments and PIX, Brazil’s most popular payment method.

In a nutshell: if you want to increase your profits and thrive in the Brazilian market, you will need to meet local requirements.

The good news? Payment processors like CommerceGate can help you boost your sales in Brazil with proprietary payment solutions, streamlining, and simplifying the consumer experience while also increasing authorization rates.

Plug Into LATAM With CommerceGate And Increase Sales In Brazil

CommerceGate specializes in providing local, robust, and secure payment solutions that support diverse online businesses in Brazil and LATAM.

With CommerceGate, your business can count on:

- A registered, regulated, and licensed entity by the Bank of Spain and fully authorized in Brazil and LATAM.

- An entity audited by KPMG (as a member of the Big Four), ensuring quality and reliability.

- High-security standards by partnering with a PCI DSS Level 1-Certified company.

- Licensed operations to minimize disruptions, like account blocks.

- AI-enabled fraud prevention backed with decades of experience in trusted payment services.

CommerceGate’s tailored solutions and dedicated customer success team give your business access to Brazil’s most popular local payment methods – such as PIX, Boleto Bancario, and local cards like ELO, Aura, and Hipercard – and customized payment solutions catering to operators in Brazil.

Get immediate access to funds and swift, transparent fund transfers with fair exchange rates, as well as detailed transaction analysis for complete control.