Forex isn’t a regulated activity in Brazil, meaning domestic financial institutions cannot offer this service. However, Brazilians can carry out transactions through foreign financial institutions. This presents a significant opportunity for Forex businesses targeting the Brazilian market as they will not encounter local competition.

Wondering how your Forex business can attract Brazilian consumers?

If your business is targeting LATAM’s largest economy, then you might want to consider tailoring your operations to attract and retain Brazilian consumers.

And there’s more to this than simply translating your website. This also includes offering local payment methods like Pix to provide a seamless experience for Brazilian users.

In this article, we’ll explain why your FX business should consider offering Pix.

But before we do, we’ll uncover…

The Brazilian Market And Its Opportunities

Forex isn’t a regulated activity in Brazil, meaning domestic financial institutions cannot offer this service. However, it isn’t illegal for Brazilian investors to engage in this type of activity. Brazilians can carry out transactions through foreign financial institutions.

This presents a significant opportunity for FX businesses targeting the Brazilian market as they will not encounter local competition. Further, according to stock exchange B3, there are 1M+ day traders in Brazil, which indicates Brazilian’s appetite for activities of the sort.

Read Also:

- Payment Regulations In Brazil: Requirements You Need To Meet For Payment Processing In Brazil

- A 5-Minute Guide To Expanding Your Forex Trading Business In Brazil And LATAM

- Factors Driving Growth For Forex Trading Across LATAM

However, businesses looking to thrive in the region must offer alternative payment methods like Pix to attract and retain consumers.

Why Pix?

Pix is Brazilians’ favorite payment method. With over 155M+ users, achieving 92% penetration among the adult population1, the instant payment method allows instant digital transactions with amounts as low as R$ 0,01, twenty-four hours a day, seven days a week.

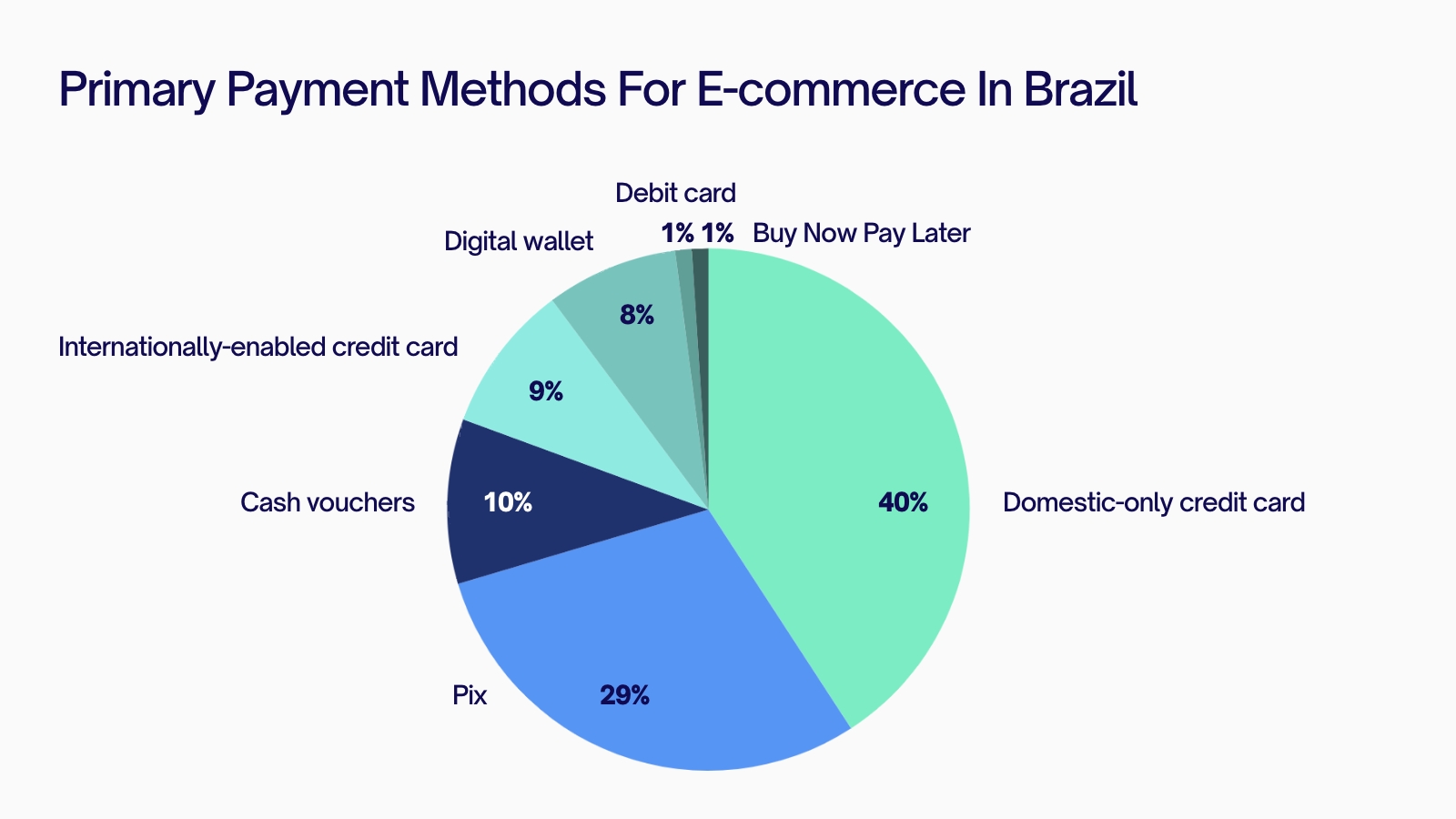

According to PCMI’s latest report, Pix is the second most used payment method in e-commerce in Brazil, by share of volume:

Source: https://paymentscmi.com/our-global-payments-market-research-services/latin-america-e-commerce-digital-payments-data

Installment payments, available only with domestic credit cards, are likely the main obstacle preventing Pix from gaining a larger market share.

Tips To Offering Pix For Brazilian Users

Want to embed Pix into your checkout? Then there are three things you should consider:

1. User Experience

Pix is a user-friendly payment method. When used for online P2B payments, users can simply use their mobile devices to scan a QR code or use “Pix Copia e Cola”, allowing them to easily copy and paste the Pix code into their banking or digital wallet apps to complete the payment.

However, to enhance the payment experience even further, businesses must focus on offering a seamless UX, including a good response time, fast payment approval time, and minimum friction.

2. Dynamic And Static Pix Flows

Integrating Dynamic and Static Pix QR code flows is also an important strategy for FX businesses.

Dynamic Pix QR Codes are indispensable for maintaining high security and customization of transactions. Each transaction requires a new QR code, which means payment details are always up-to-date and specific to each transaction.

Static Pix QR Codes, on the other hand, allow traders to quickly and easily repeat transactions, perfect for those who might be purchasing trading credits or settling regular payments. The flexibility to set or not set a fixed amount offers payers the convenience to decide how much they wish to transact, enhancing their control over the payment process.

3. AML Checks

Implementing effective Anti-Money Laundering (AML) measures is imperative for maintaining the integrity and credibility of FX platforms.

AML solutions help identify, prevent, and report potentially fraudulent financial activities. These solutions use sophisticated algorithms to analyze vast amounts of transaction data and detect anomalies that could suggest money laundering activities.

For FX platforms, where large sums of money move across borders frequently, AML tools are essential for monitoring transaction patterns and ensuring compliance with both local and international regulatory standards.

Meet CommerceGate, Your Payment Advisor In Brazil

CommerceGate is at the forefront of advancing payment processing in LATAM, providing payment solutions adapted to the local market. Benefit from proprietary Pix flows covering Dynamic and Static QR codes and AML checks helping you drive consumer loyalty and spending.

Book a free 30-minute consultation with one of our experts, and get started today!

_____________________________________

[1] https://paymentscmi.com/insights/brazil-e-commerce-market