The Ultimate Guide to High-Risk MCC Codes

By CommerceGate, Press Team

August 27, 2024

21 minutes read

The Ultimate Guide High Risk MCC Codes

High-risk MCC codes, their significance, and how they can influence your ability to process payments

Navigating the world of payment processing can be particularly challenging for businesses operating in high-risk industries. Among the myriad of Merchant Category Codes (MCC) used to classify business types, those deemed “high-risk” often signal greater hurdles in obtaining credit card processing services. Despite these challenges, accepting credit cards is crucial, especially in Latin America where they dominate as the preferred payment method.

Fortunately, there are merchant service providers that specialize in supporting high-risk businesses. By selecting the right provider, not only can you secure credit card processing, but you can also access essential tools and resources to safeguard your business from financial risks.

This guide will walk you through high-risk MCC codes, their significance, and how they can influence your ability to process payments.

What is a High-Risk MCC Code?

When a business applies for a merchant account, it is assigned a four-digit Merchant Category Code (MCC) along with a Merchant Identification Number (MID). While the MID identifies the individual merchant, the MCC code classifies the type of industry the merchant operates in.

High-risk MCC codes designate businesses operating in sectors with elevated payment processing risks. These industries often experience higher rates of chargebacks, fraud, and disputes. Consequently, many payment processors are hesitant to work with high-risk merchants due to the increased liability.

Beyond risk assessment, MCCs serve other critical functions. Card networks like Visa and Mastercard use them to determine interchange fees, establish industry-specific rules, and provide incentives. For instance, businesses with high-risk MCCs processing card-not-present transactions might require additional registration due to increased fraud risks. These regulations aim to protect the entire payment ecosystem while ensuring access to payment processing for high-risk merchants.

Essentially, high-risk MCC codes reflect a business’s potential for payment-related issues, influencing the terms and costs of payment processing.

High-Risk MCC Codes

| MCC Code | Category | Description | Registration Required |

| MCC 4411 | Cruise lines | Cruise lines | |

| MCC 4511 | Aircraft and aviation | Airlines, not elsewhere classified | |

| MCC 4582 | Aircraft and aviation | Aircraft and aviation | |

| MCC 4722 | Travel Agencies and Tour Operators | Travel arrangements, tours, charters | |

| MCC 4812 | Telecom Sales and Equipment | Telecommunication devices | |

| MCC 4814 | Telecom Services | Telecommunication services | |

| MCC 4816 | Computer Network Services | Internet service providers | |

| MCC 4829 | Wire Transfers and Money Orders | (+ other similar services) | |

| MCC 5094 | Jewelry and luxury goods | Jewelry and luxury goods | |

| MCC 5122 | Drugs, Proprietaries & Sundries | (+ other similar services) | Yes |

| MCC 5192 | Jet charter | Jet charter | |

| MCC 5511 | Vehicle sales and financing | Vehicle sales and financing | |

| MCC 5712 | Furniture stores | Furniture stores | |

| MCC 5912 | Drug Stores and Pharmacies | (+ other similar services) | Yes |

| MCC 5962 | Direct Marketing – Travel | Includes discount clubs | |

| MCC 5964 | Direct Marketing – Catalog | Mail and telephone orders | |

| MCC 5966 | Direct Marketing – Outbound | Mail and telephone orders | |

| MCC 5967 | Direct Marketing – Inbound | Adult content merchants, Teleservices, audio & videotext | Yes |

| MCC 5968 | Direct Marketing – Subscription | Recurring subscriptions | |

| MCC 5969 | Direct Marketing – Other | Radio and TV sales | |

| MCC 5921 | Cigars, Tobacco | Alcohol and tobacco products | Yes |

| MCC 5993 | Cigars, Tobacco | Includes stands | Yes |

| MCC 6051 | Bitcoin and cryptocurrency | Bitcoin and cryptocurrency | |

| MCC 7021 | Timeshares | Rentals, leases and sales | |

| MCC 7273 | Dating and Escort | Various dating services | |

| MCC 7375 | Web design companies | Web hosting and internet services | |

| MCC 7399 | Business Services – Not Elsewhere Classified | Diverse and uncategorized business services | |

| MCC 7841 | Video Tape Rental Stores | Adult content | Yes |

| MCC 7922 | Ticketing Agencies | Secondary ticketing | |

| MCC 7991 | Event planning and ticket sales | Event planning and ticket sales | |

| MCC 7994 | Video Games and Arcades | Skill Games requires registration | Yes |

| MCC 7995 | Betting and Casino Gambling | Online casino, lottery, wagers | Yes |

| MCC 8099 | Healthcare and medical services | Healthcare and medical services | |

| MCC 8299 | Education and tutoring services | Education and tutoring services | |

| MCC 8398 | Cannabis and marijuana products | Cannabis and marijuana products | |

| MCC 9399 | Government Services | State Lottery Requires Registration | Yes |

Mandatory Registration for High-Risk MCCs

Certain high-risk industries, such as gambling (MCC 7995), or video games (MCC 7994), require mandatory registration with card associations for enhanced risk monitoring. This process involves adhering to specific regulations and paying annual fees typically ranging from 480 to 950 (€). By imposing these measures, card associations aim to mitigate risks associated with these businesses, protecting both service providers and consumers.

Fees and Rates: The Impact of MCC

Your business’s Merchant Category Code (MCC) significantly influences the cost of processing customer payments.

Interchange Rates

The core fee you pay to accept credit cards is the interchange rate. This fee is charged by the customer’s bank for processing the payment. While various factors determine interchange rates, your business’s MCC is a key influencer. High-risk businesses, as categorized by their MCC, typically face higher interchange rates due to the increased risk of fraud and chargebacks.

Cardholder Fees

Cardholder fees are charges passed on to the customer to offset processing costs. However, not all businesses can impose cardholder fees. The ability to do so is determined by your MCC. For instance, government services are often permitted to charge these fees, while most other businesses are not.

Chargeback Fees

Chargebacks occur when a customer disputes a transaction. High-risk businesses are more susceptible to chargebacks. As a result, they typically face higher chargeback fees. These fees can vary significantly between providers and can be a substantial expense.

Monthly Fees

Many high-risk merchant account providers impose monthly fees. These fees cover the costs of managing the increased risk and providing specialized services. The amount of the monthly fee can vary widely based on the provider and the specific risks associated with the business.

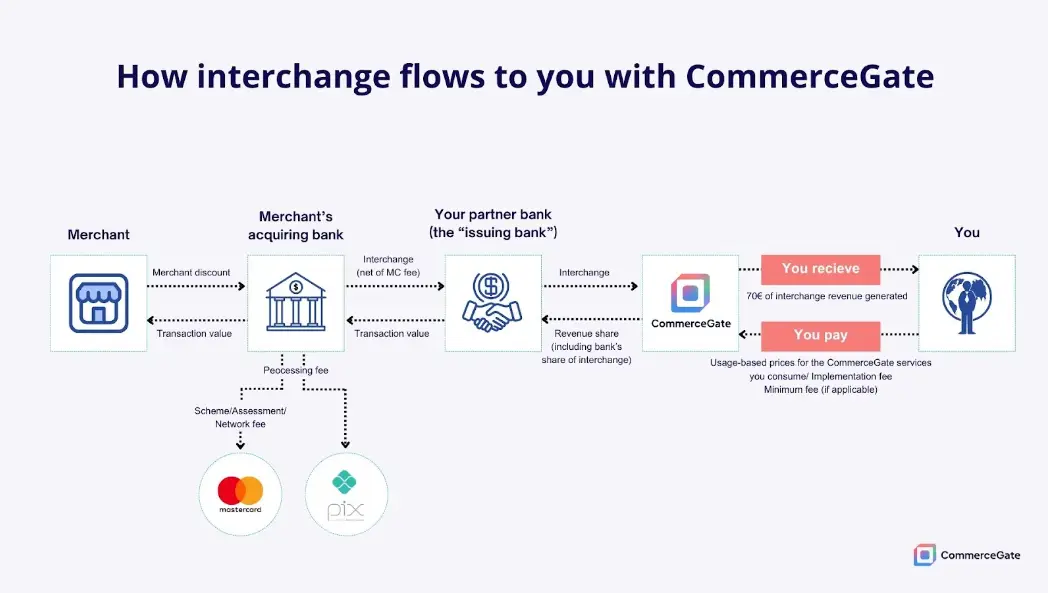

How interchange flows to you with CommerceGate

Navigating the High-Risk Merchant Account Landscape

Businesses classified as high-risk due to their MCC often encounter significant challenges in securing traditional merchant services. Fortunately, specialized high-risk merchant account providers cater to these industries.

By partnering with a high-risk merchant account provider, businesses gain access to essential payment tools like credit card processing, payment gateways, and virtual terminals. These providers possess in-depth knowledge of the unique challenges faced by high-risk industries and offer tailored solutions such as higher chargeback thresholds and industry-specific support.

If your business operates in a high-risk sector, securing a suitable merchant account is crucial. By selecting a reliable provider with expertise in your industry, you can ensure your business has the necessary payment infrastructure and support to thrive.

CommerceGate: Your Trusted Partner for High-Risk Businesses in LATAM

If you’re an online business operating in a high-risk industry, especially within the dynamic markets of Latin America, CommerceGate is your ideal partner. We offer secure, reliable, and fully compliant payment solutions tailored for Brazil, Mexico, Colombia, Chile, Peru, and Ecuador. Our deep understanding of local regulations, combined with cutting-edge technology like our native PIX Payment solutions in Brazil, ensures seamless transactions, enhanced customer experiences, and higher authorization rates.

With decades of experience and advanced AI-enabled fraud prevention, CommerceGate delivers the trust and security your business needs to thrive. Our cloud-based payment platform offers99.999% reliability, providingyou unmatched transparency, immediate access to funds, and detailed transaction analysis for complete control over your operations.

Choose CommerceGate to unlock the full potential of your online business in Latin America’s high-growth markets. Let us accelerate your growth and profits with our tailored payment solutions, designed to meet the unique demands of high-risk industries.