The Huge Growth Potential of Brazil’s Online Sports Betting Market offers a Plethora of Opportunities

While football may be synonymous with Brazil, the sports-loving nation is also known for its success in volleyball, basketball, tennis, MMA and Formula One. Sports are a part of people’s everyday life and an essential component of the nation’s identity. The country also has a young population of gaming enthusiasts. Combine that with 60 million people entering the middle class over the last 15 years, technological developments and rapid adoption of the internet, it’s no wonder that the sports betting and iGaming industries have experienced remarkable growth in the region.

Now that sports betting is set to be regularized, it is likely to see unmissable opportunities going forward. Dive deeper into the Brazilian online sports betting landscape and learn how your business can benefit from expanding to the country.

Current Status of the Brazilian Sports Betting Market

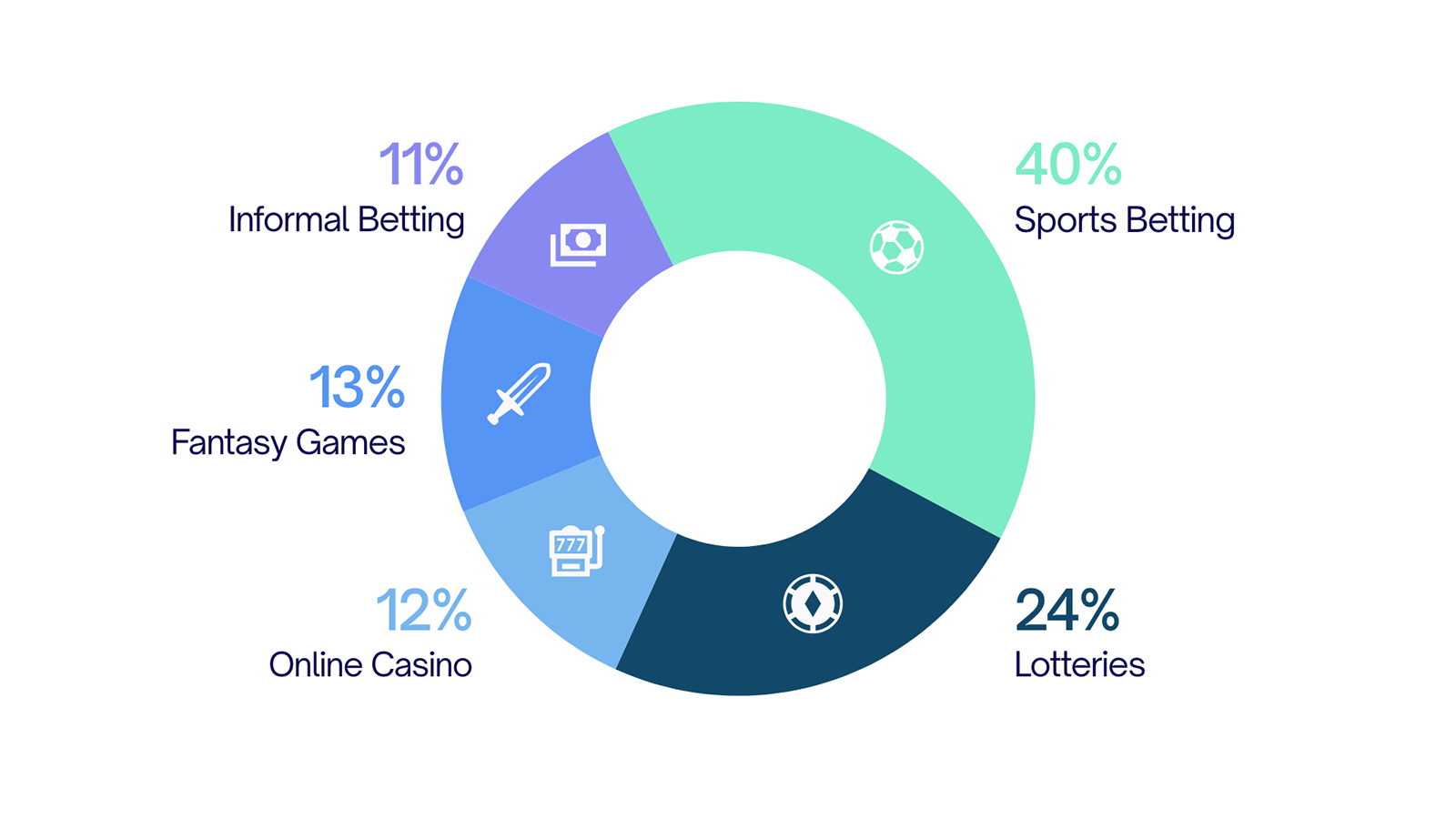

Brazil has a cultural affinity to sports and gaming. Two-thirds of the adult population of the country were engaged in real money games in 2022. With 86.43% of the bettor participation being online[1], the real-money market is majorly internet-based.

Brazil’s Gaming Legacy

Joga Bonito or “the beautiful game”, emphasizes the love for football and underlines its popularity in the country. Over 20 million or about 10% of the total population play the game every day.

As of 2024, Brazil’s mobile app casino market is valued between US$35 million and US$40 million, which is just under 2% of the global online casino market’s value. While multi-game apps are prevalent for sports betting, casinos have drifted towards mobile-site-based formats. Currently these are largely unstructured and take advantage of the massive demand for real-money games in the country.

Source: https://env.media/brazilian-market-overview/

Regulatory Landscape for Sports Betting and iGaming

Poker, non-commercial Bingo, fixed-odds sports betting, horse race betting, fantasy betting, lotteries, social gaming, and skill-based iGames are currently not significantly regulated. However, on December 30, 2023, the Brazilian President signed a framework (bill proposal) for sports betting and iGaming – there were a few vetoes which are currently being analyzed and ironed out.

The regulation is expected to be executed with guidelines from the Ministry of Finance by the second half of 2024. We will monitor this process closely.

Amazingly, 130 operators were eager to apply for licenses soon after the bill was passed, underscoring the plethora of opportunities the bill may extend to the gaming market in Brazil.

Before the bill proposal had been passed, over 450 platforms were operating online[2] in the country. Now, with a proposed regulatory framework, the industry is set to generate more local jobs, and revenues, enriching the entire online gaming value chain.

Running alongside this bill, there are actually several entities that govern operations and often issue licenses for different types of physical betting and lotteries in the country. These include the Caixa Econômica Federal (lotteries), and MAPA (horse racing).

Brazilian bettors view the government’s move as a step towards reducing risk and increasing security across online platforms. In fact, 71% of bettors believe that the government should continue to invest and lay down clear guidelines for the betting market, and 76% say that this can help the industry evolve responsibly. Additionally, the government is expected to release regulations for casinos soon to strengthen the country’s economic position via tourism.

Prospects of Sports Betting and iGaming in Brazil

The online gambling industry is forecasted to reach US$3.63 billion by 2028[3], exhibiting a CAGR of 16.51% from 2024 to 2028.

The evolution of the regulatory environment is expected to make the industry even more attractive for operators worldwide. Such expectations are already spurring investments in the sector. Neil Montgomery, an online gaming advocate, expects an “avalanche of foreign direct investment” once clear guidelines are out.

The country is set to hold the first edition of Gambling Brasil[4] to bring companies, agencies, and advertisers, along with social media personalities, onto a common platform to share insights on online sports betting.

The cultural passion for sports and gaming is an asset for an industry primed for spectacular growth, while the regulatory environment encourages responsible participation. These have made Brazil the hottest market on the horizon for merchants and operators who want to expand to LATAM.

However, establishing a solid relationship with local partners is crucial to gain insights into the domestic market and consumer preferences. For instance, local bettors place smaller, more passionate, and intuitive bets, rather than their counterparts in Europe, who place larger and infrequent bets. Additionally, the growing demand for betting and online casinos is the by-product of an increased need for diverse sources of digital entertainment, amid the deepening penetration of the Internet.

Cutting-Edge Payment Technology to Empower Your Business

To thrive in Brazil, you must adopt a customer-centric approach to your offerings, customer support, and enabling easy participation. Did you know that 38% of Brazilians consider betting a sport in its own right, and 12% rely on online gaming as the primary source of revenue. This is in addition to the 67% Brazilians who participate in online gaming for entertainment. Since real-money gaming is a huge part of the culture, enabling players to transact through their preferred payment modes is essential to optimizing revenues.

Merchants planning to enter the region must equip their platforms with integrated payment solutions, adapted to the Brazilian and LATAM market. PIX had established itself as the most popular mode of online payments in the country within 3 years of its launch due to the straightforward payment acceptance across platforms with high reliability.

CommerceGate is a leading payments enabler in Brazil and LATAM, providing Payment Services Provider and Payment Facilitator services to global merchants with a local team and office in Brazil. We also have an extensive payment partnership and referral program in place for Brazil and Latam.

CommerceGate’s proprietary and unique PIX solution offers unique benefits, improving our merchants’ operational and commercial effectiveness, efficiency and client LTVs:

- Instant access to funds in BRL (Brazilian Real), with no FX charges applied.

- Proprietary PIX flows covering Dynamic and Static QR codes.

- Average transaction time of only 3.7 seconds.

- Advanced PIX fraud prevention with a unique QR-code created for each individual user tax-ID.

- Fully transparent pricing tiers with no hidden fees.

- Transparent FX and overseas settlements.

With nearly two decades of providing reliable solutions for the industry, our highly customizable proprietary solutions streamline payments and reconciliation while simplifying consumer experiences and improving authorization rates.