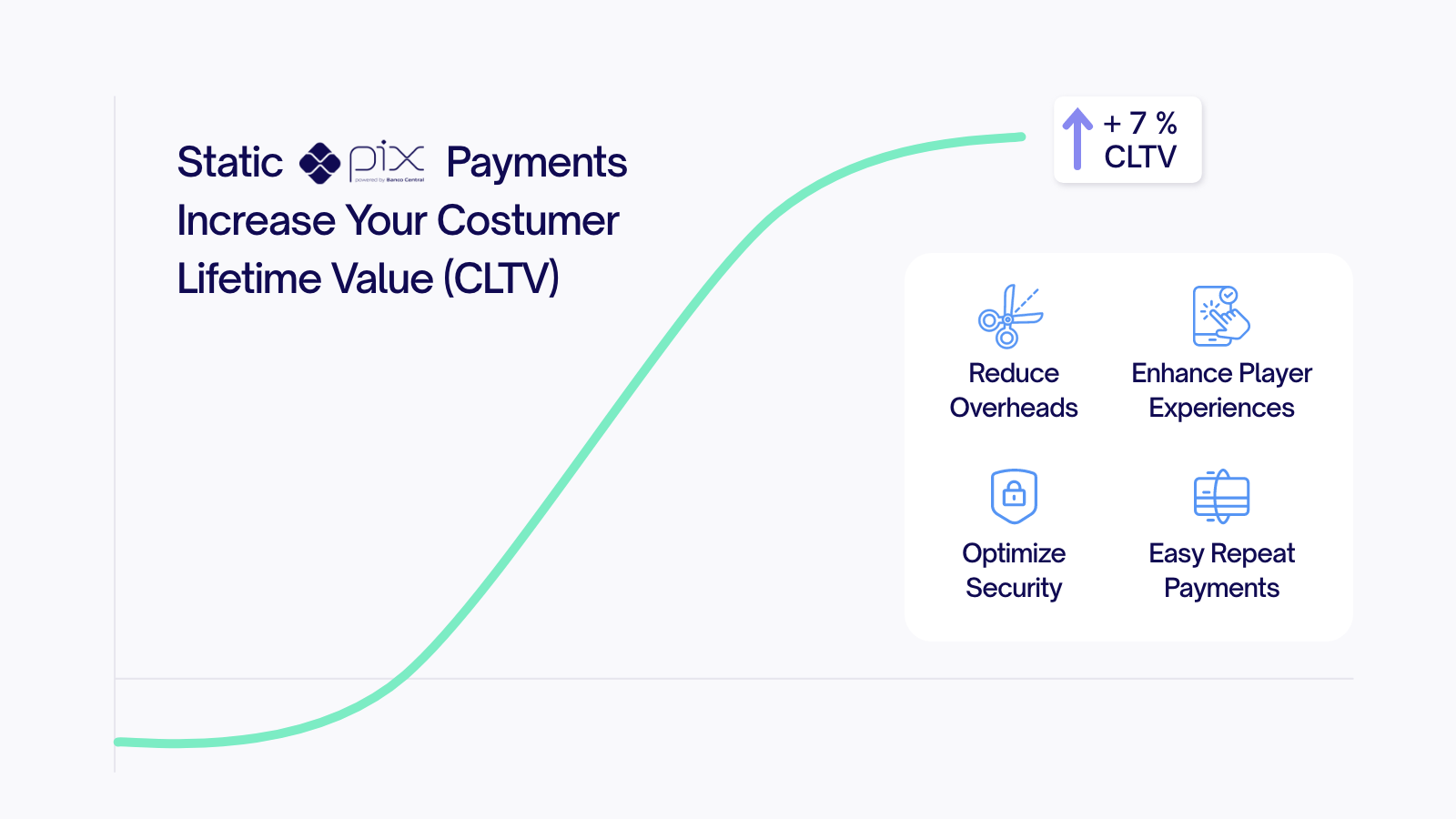

Static PIX QR Codes enhance the payment process, especially for repeat transactions or quick deposits with the same amount. This leads to a proven increase of 6-7% in deposits for merchants, and quicker and seamless experiences for customers.

While classic Brazilian bank transfers, such as DOC (Money Order Document) and TED (Wire Transfer of Available Funds) become dated, PIX is driving a huge transformation in the Brazilian payments landscape. Being at the forefront of payment digitization, PIX payments have made Brazilians very comfortable with digital payments, while offering online merchants multiple benefits.

However, compared to dynamic PIX transfers, PIX Static QR Codes enhance the payment process, especially for repeat transactions or quick deposits with the same amount. This leads to a proven increase of 6-7% in deposits for merchants, and quicker and seamless experiences for customers.

Discover how the static PIX QR Code can increase customer lifetime value (CLTV) for your online business in Brazil.

Integrating Static PIX QR Codes Speeds Up Transactions

PIX is the brainchild of the Banco Central do Brasil (BCB), and a trusted payment mechanism and merchant platform. For static PIX payments, a single QR code is created for a specific transaction amount which then can be conveniently reused in the future. This static QR code prevents the delays associated with dynamically generating QR codes or entering recipient details for every payment.

The main difference between static and dynamic PIX QR codes is that the dynamic code is unique for each transaction. To make repeat payments, the user needs to go through the cashier again, select the payment method, enter the required payment amount, and possibly input additional details, depending on the provider’s requirements.

In contrast, a static QR code only contains the recipient’s account number, providing a faster and simpler payment process, especially for recurring payments. After the first payment, the user can simply repeat it in their banking app, increasing convenience and boosting customer lifetime value (CLTV) by 6-7% (based on statistics collected by CommerceGate’s partners using Static QR).

CommerceGate Powers You to Leverage PIX Payments

CommerceGate is a registered, certified, and consistently audited financial technology provider that supports iGaming businesses establishing their foothold in Brazil.

Through API-based flexible integrations, our solution optimizes your payment capabilities at every touchpoint. Our proprietary PIX Payment Solution covers all use cases to enable payments in all working scenarios across business processes. We maintain compliance with business-specific and regional policies, while also adhering to regulatory guidelines through a unique point of integration.

PIX Expertise that Transforms Payments for Your iGaming Business

The vibrant Brazilian market is poised for tremendous growth. Online businesses that adopt PIX payments will be better positioned to stay competitive by offering localized payment experiences.

Our PIX payments solution is an affordable and user-friendly mechanism that online businesses can leverage to enhance interoperability. It allows you to create static QR codes that can be displayed on your website, sent via email, or shown on the screen when a user’s balance is low. Plus, you have complete control, without the need to communicate with CommerceGate’s platform for its display, ensuring instant service delivery to the customer.

To prevent fraudulent use of static QR codes, we analyze the CPF (Brazilian Tax ID) of all payments made using the same QR code. If a payment is made with a different CPF, we can automatically refund the money to the sender’s bank account, helping prevent fraudulent activity. This automatic refund process helps protect you against potential complaints and provides an additional layer of security. We can also disable this system, giving you the flexibility to react to user behavior as you see fit.

This static QR code flow can also be used in marketing funnels. For example, during a football match, marketing creates push messages, banners, etc., offering incentives like “Bet 10 BRL on the Bragantino vs. Botafogo game and get 10 BRL extra.” The potential customer clicks and lands on a page with a QR code for a 10 BRL payment.

After the payment, the user confirms their email or phone number for registration, and upon return to your platform, they receive their 10 + 10 BRL. When filling out the profile, if they enter a different name or CPF from the first payment, you can react or wait for a larger amount or withdrawal request. In any case, you have fraud indicators at your disposal to act quickly.