With nearly 60% of sports betting consumers being ages between 22 and 36, it is no surprise this industry would gain traction among Brazil’s tech-savvy population. But there’s one more element that is driving growth in the Brazilian sports betting market. And it’s called Pix.

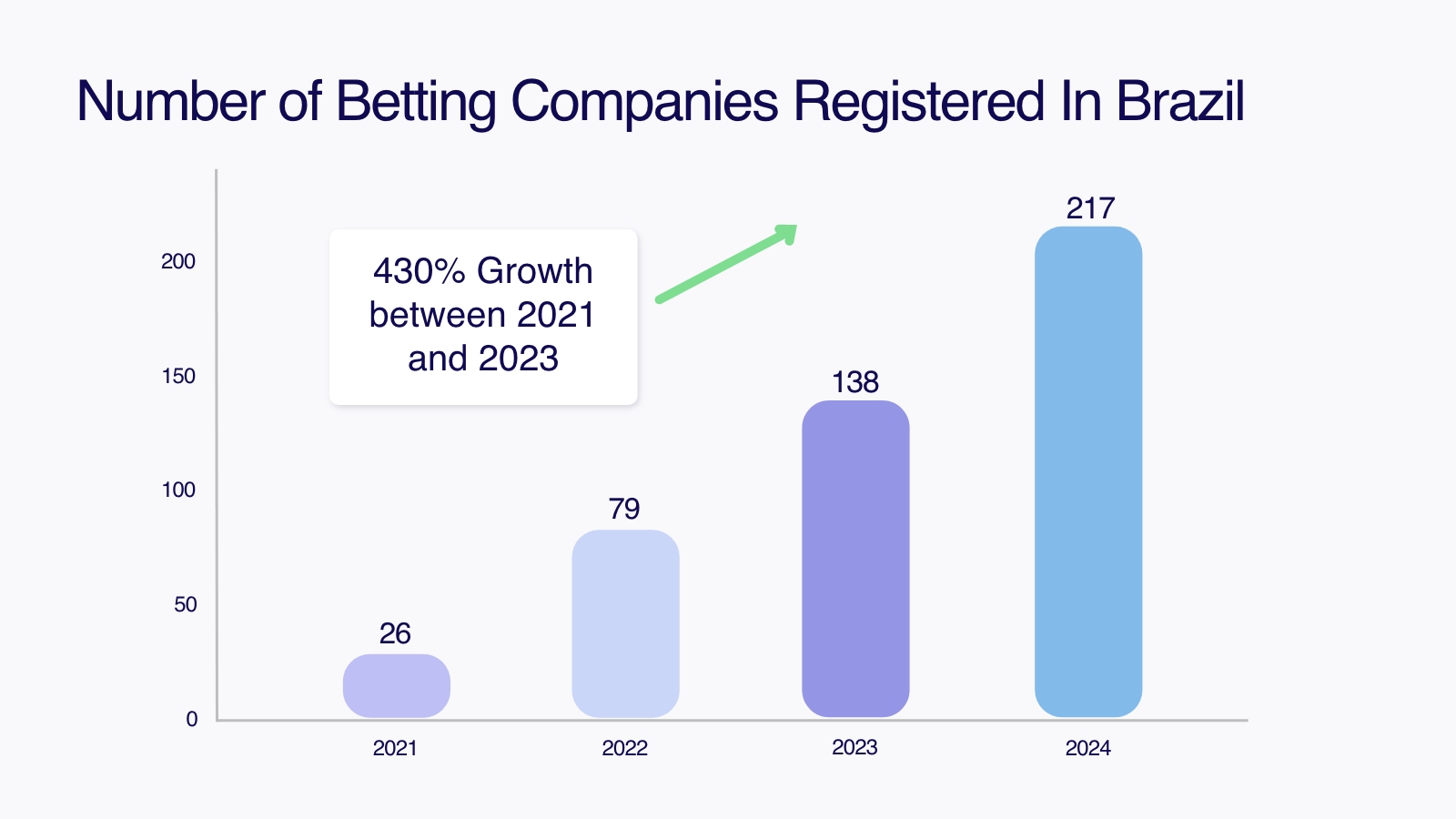

The Brazilian sports betting market is facing astonishing growth: according to a recent analysis carried out by Datahub[1], the online betting sector grew 734,6% between 2021 and April 2024, going from 26 to 217 registered companies operating in the region.

Sports betting has been legally recognized as a legitimate operation in Brazil since December 2018. However, it wasn’t until 2023 that new regulations took place, giving companies and consumers a safer business environment that favors natural growth.

Source: DataHub

Technology As The Ultimate Game-Changer

According to the analysis, this growth can be attributed to the increased adoption of tech services during the pandemic. Due to the restrictions imposed by COVID-19, Brazilians became even more familiar with online betting – an activity previously restricted to physical lottery agencies. With nearly 60% of sports betting consumers being ages between 22 and 36, it is no surprise this industry would gain traction among Brazil’s tech-savvy population.

But there’s one more element that is driving growth in the Brazilian sports betting market. And it’s called Pix.

CommerceGate’s Unique Pix Solutions For Sports Betting

Pix is Brazil’s instant payment method developed by the Central Bank of Brazil. Launched in November 2020, the payment method has compounded over 155M users, introducing 71.5M Brazilians into the financial system, according to data from the Central Bank of Brazil.[2]

Pix is free of charge and easy to use: users can transfer amounts as low as R$ 0,01 to accounts from different banking institutions, and the amount is immediately made available 24/7.

Pix’s increasing popularity has not only helped millions of Brazilians with their daily lives, but it has also enabled online sports betting companies to gain leverage and attract new users. According to a study carried out by Gmattos[3], Pix’s financial transactions were expected to move around R$ 53B by the end of 2023.

The main reason? Instant transactions and ease of depositing and withdrawing funds led consumers who previously used other modalities to migrate to online betting. Another research[4] showed that Pix is the favorite payment method for 90% of online betting users.

Accept Payments With Pix In Your Online Betting Platform

Accept payments with Pix while also offering consumers a seamless payment experience, with fewer steps to complete deposits. CommerceGate’s proprietary Pix flows cover Dynamic and Static QR codes, helping increase consumer loyalty and spending.

Dynamic Vs. Static QR Codes: Understand The Difference

Dynamic Pix QR Codes are unique for each transaction, as users must enter the required payment amount and input additional details depending on the receiver’s requirement.

Static QR code, on the other hand, only contains the recipient’s account number, providing a seamless payment experience – especially for recurring payments.

After the first payment, users can simply repeat the process in their banking app, increasing convenience and boosting your platform’s Lifetime Value (LTV) by up to 7%.

Anti Money Laundering Checks with CPF-Lock

CommerceGate’s solution also enables merchants to create a QR code for specific CPFs (Brazilian taxpayer ID), ensuring control over payments and guaranteeing they come from verified users. This feature allows merchants to transmit the CPF code to CommerceGate and, with an additional parameter, decide whether to generate a QR code specifically for the named user. The QR code can be easily paid from any bank account, provided the account holder has the same CPF provided by merchants.