Although Brazilian investors are free to engage with Forex trading, businesses targeting the Brazilian market must take caution to avoid penalties.

The Forex (FX) market in Brazil operates uniquely. Despite the absence of specific regulations, it isn’t illegal for local investors to engage in this type of activity.

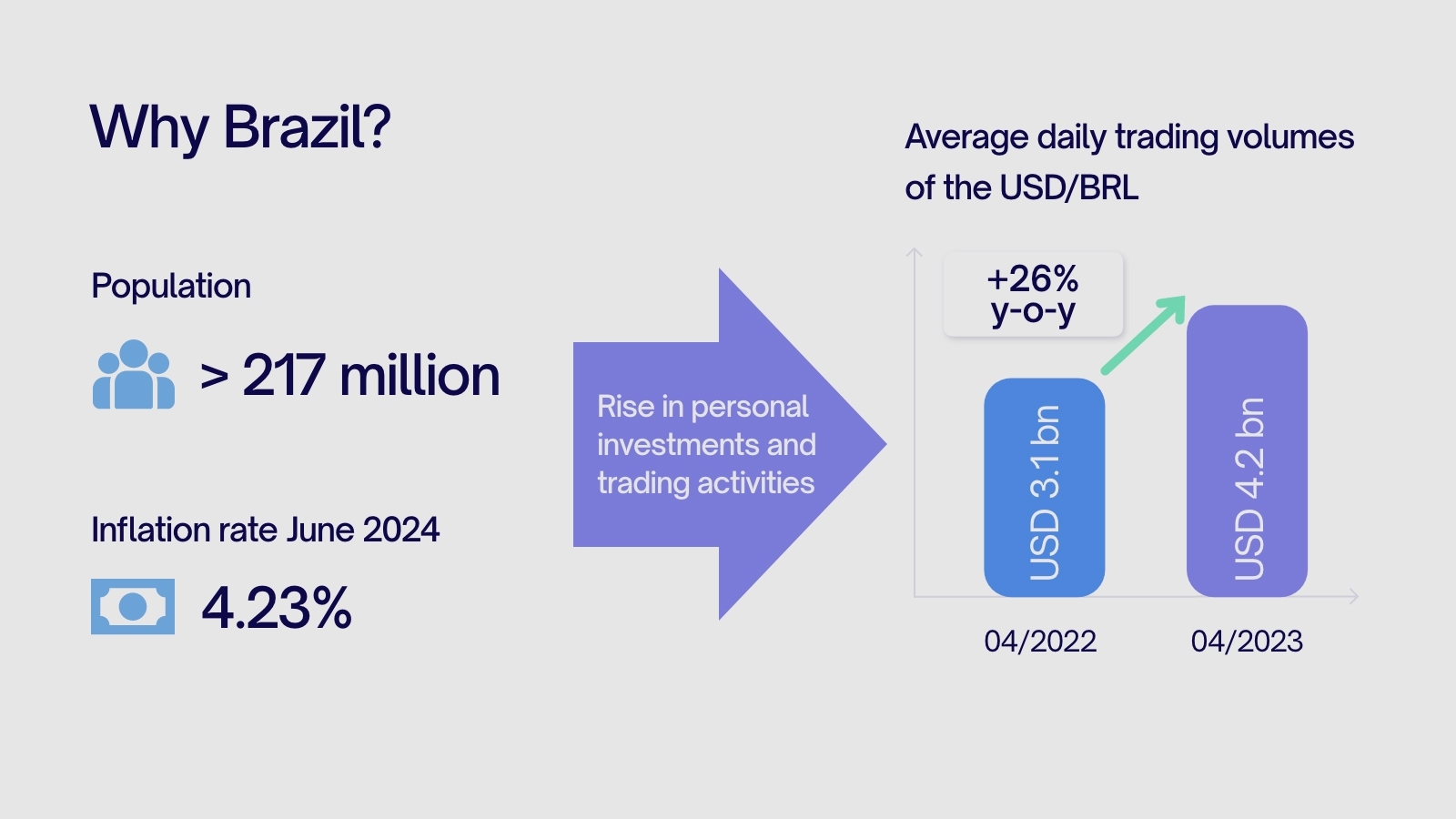

This indicates an outstanding opportunity for FX platforms entering the region. The Brazilian stock exchange B3 has recorded over 1M+ day traders¹, demonstrating a strong interest among investors in this type of activity.

In this article, we’ll uncover the regulatory landscape for Forex businesses in Brazil so your business can remain compliant.

Let’s get started!

Forex Market In Brazil: Regulatory Landscape

The Securities and Exchange Commission, or Comissão de Valores Mobiliários (CVM), in PT-BR, is the government institution responsible for regulating and supervising the capital markets in Brazil. Its core activities are:

- Setting regulations.

- Monitoring compliance.

- Penalizing those who breach compliance.

- Foster the development of a fair and transparent market.

The CVM, which oversees and regulates the stock and asset markets, does not have records of Forex investment. Therefore, transactions carried out by investors must be conducted through foreign financial institutions.

In a nutshell:

- There are no authorized domestic Forex brokers in Brazil. This is due to regulations from the CVM, making it an unregulated market. Thus, Brazilian institutions are prohibited from offering this type of operation.

- On the flip side, Forex trading is not prohibited in Brazil. However, a brokerage based in Brazil cannot offer this service. Any Brazilian investor can send money abroad and invest in the FX market through a foreign brokerage.

Read Also:

- Payment Regulations In Brazil: Requirements You Need To Meet For Payment Processing In Brazil

- A 5-Minute Guide To Expanding Your Forex Trading Business In Brazil And LATAM

- Factors Driving Growth For Forex Trading Across LATAM

Source: https://www.fx-markets.com/trading/7949010/latam-electronification-a-market-stuck-in-the-past

Cautions Your FX Business Must Have To Meet Compliance

Although Brazilian investors are free to engage with Forex trading, businesses targeting the Brazilian market must take caution to avoid penalties.

Dolphin Corp, the owner of the Binomo trading platform, agreed to pay a R$ 2,4M fine to CVM to settle an administrative case for “irregular operations in Brazil”, initiated in 2022, as reported by local news Valor Investe².

In July 2020, Dolphin received a stop order from the CVM for irregular operations in Brazil related to client recruitment “for conducting transactions with securities, especially in the so-called Forex (Foreign Exchange) market”. However, in 2022, the regulator received complaints that the company was still operating in the Brazilian market and initiated a new proceeding.

In addition to the fine, Dolphin made adjustments to the Binomo website content, explicitly indicating that the operations and products are not available to Brazilian clients, and including a warning that it is not authorized by the CVM to operate in the country.

It is worth mentioning that this type of measure is used by the CVM to “prevent or correct abnormal situations that are detected”, but does not constitute a conviction per se³. According to the CVM, it is common to identify irregular investment offers in the Forex market made by unauthorized institutions operating in the Brazilian market. These offers, often advertised on social media, are filled with promises of high returns and don’t always adequately inform investors about the risks involved, claims the institution. You can find further details in the CVM’s official guide here (in Portuguese).

CommerceGate Helps Your Business Meet Compliance In LATAM And Brazil

CommerceGate is your payment adviser in LATAM providing frictionless Customer Experience with local payment solutions. With CommerceGate, your business benefits from:

- Access to the most popular local payment methods, i.e. Pix, boleto bancario, and local cards like ELO, Aura, and Hipercard.

- Customized payment solutions catering to operators in Brazil.

- Dedicated Customer Success Managers to get local solutions to the other level of expertise.

- Licensed operations to minimize disruptions like account blocks.

Get immediate access to funds and swift, transparent fund transfers with fair exchange rates, as well as detailed transaction analysis for complete control.

Increase your sales in Brazil with CommerceGate. CommerceGate specializes in providing local, robust, and secure payment solutions that support diverse online businesses in Brazil and LATAM. Book a free 30-minute consultation with one of our experts, and get started today!

_____________________________________