Due to high potential returns, Brazil has become the target region of expansion for online gaming businesses worldwide. However, the evolving regulatory landscape could add to the complexities of establishing a strong foothold in the market. Any company aiming to enter the local market successfully will need a solid plan.

Brazil became the global leader of online betting, leaving the UK behind in 2022, when the Latin American nation’s access to these platforms grew 75%[1]. Read on to discover what this means for online gaming businesses.

Brazil’s Online Gaming Industry has a Promising Future

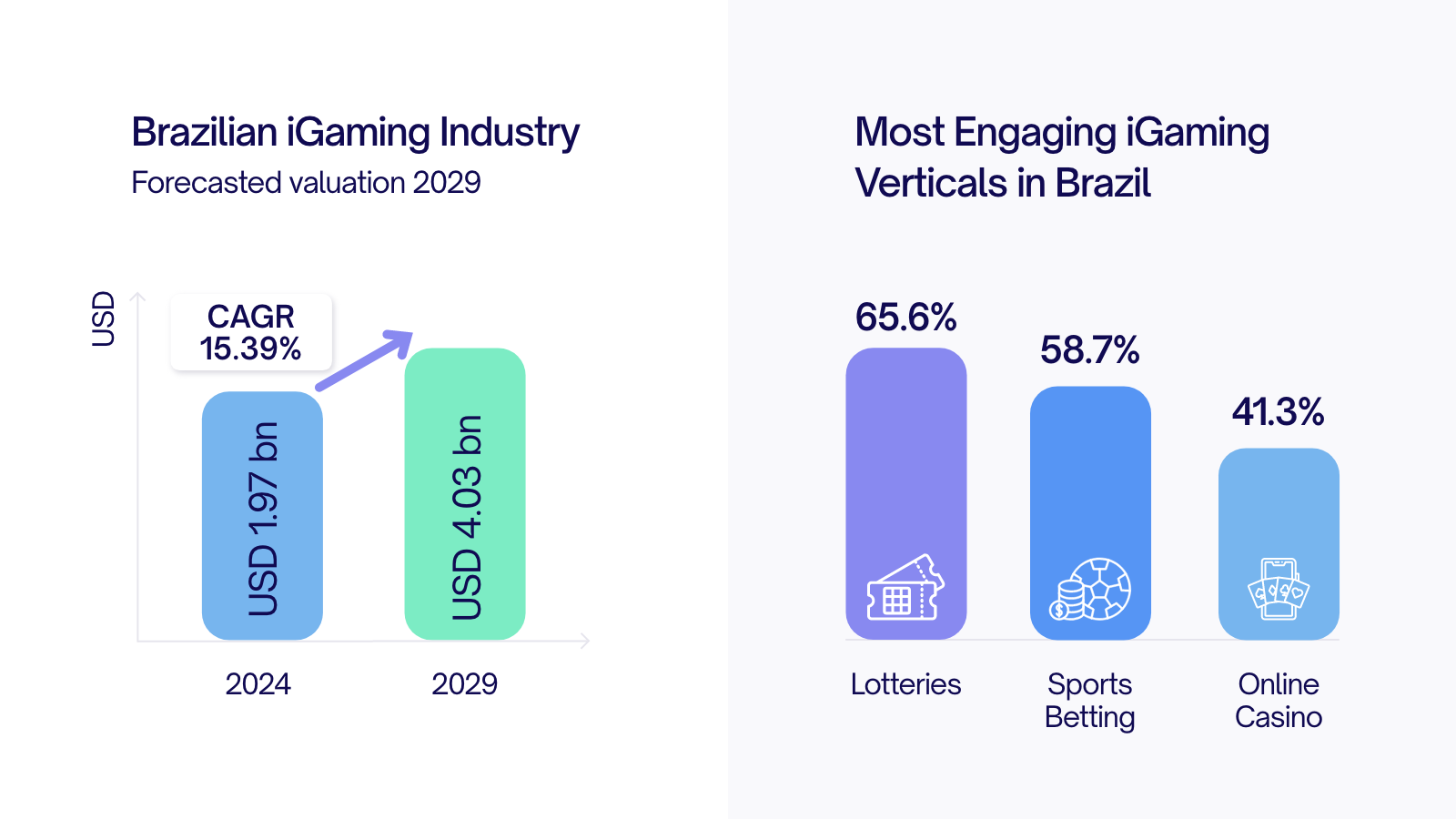

The Brazilian online gaming industry is forecasted to reach US$4.03 billion in valuation by 2029, growing at a CAGR of 15.39% from 2024 to 2029[2]. A profound love for sports and deepening internet penetration are the key drivers of this growth.

The lockdowns enforced during the pandemic drove the sports-loving nation to online sports avenues. A rise in disposable incomes, combined with the general inclination toward digital modes of entertainment, is further propelling Brazil to become a global leader in the online gaming sector. Moreover, the market’s ability to generate revenue and create jobs has also encouraged the government to foster a transparent and safe environment, further instilling a sense of confidence among iGaming enthusiasts.

Source: https://www.statista.com/outlook/amo/online-gambling/brazil

What do Brazilians Like to Play?

A survey Esse N Videri Media published in March 2024 reveals that 65.6% of Brazilian players love lotteries, 58.7% prefer sports betting, and 41.3% enjoy online casino games[3]. Virtual sports is one of the most popular segments in the online betting segment, highlighting how well the LATAM nation has embraced it. Strategic games, including Multiplayer Online Battle Arenas (MOBA) and First-Person Shooter (FPS)[4], are among the most popular gaming categories. Other popular categories include virtual card games, puzzles, and scratch cards.

How to Succeed in This Buzzing Market

Due to high potential returns, Brazil has become the target region of expansion for online gaming businesses worldwide. However, the evolving regulatory landscape could add to the complexities of establishing a strong foothold in the market. Any company aiming to enter the local market successfully will need a solid plan. Here’s what that plan needs to include:

Integrated Payments

Understanding players’ needs and preferences and offering them what they want is key. The improvement most desired by Brazilian bettors is faster payments. About 45% of players agree with this. Being the land of PIX payments, one of the most rapidly adopted online payment systems, the ask is justifiable. Therefore, establishing seamless payment flows from within the game, and outside it, is non-negotiable.

Superior Security

Employing stringent security measures is critical to providing safe transaction environments to users. With the escalating threats in the digital space, adopting stringent KYC and AML measures is paramount to garnering user trust.

The CommerceGate Payment Solution to Success

At CommerceGate, we have developed a highly reliable and platform-agonistic PIX solution that empowers businesses from across the world to operate seamlessly in Brazil. Including unique features such as linking CPF IDs and herewith locking Tax IDs with each payment, significantly reduces reconciliation overheads. The solution ensures an acceptance rate of over 85% and settlement time of less than 4 seconds (much lower than the time recommended by the Central Bank of Brazil). These help you deliver exceptional customer experiences. Additionally, FX-free conversions between pay-ins and pay-outs and no collateral requirement, empower you to operate more freely in the country.

CommerceGate’s proprietary and unique PIX solution offers unique benefits, improving our merchants’ operational and commercial effectiveness, efficiency and client LTVs (up to +7%):

- Instant access to funds in BRL (Brazilian Real), with no FX charges applied.

- Proprietary PIX flows covering Dynamic and Static QR codes.

- Average transaction time of only 3.7 seconds.

- Advanced PIX fraud prevention with a unique QR-code created for each individual user tax-ID.

- Fully transparent pricing tiers with no hidden fees.

- Transparent FX and overseas settlements.